By using modern tools, we accelerate incoming payments and reduce the associated costs in enterprisesacross the globe.

Experience Contact Sales

The Bilendo way

Conserve resources

Reduce the time and effort your accounting and sales teams spend preparing and following up dunning runs.

Increase transparency

Avoid media discontinuities and improve traceability when clarifying open items.

Increase customer satisfaction

Show your customers that you manage your finances just as professionally as your core business.

Reduce capital commitment

Increase your financial flexibility by reducing the amount of capital tied up in debit-side processes.

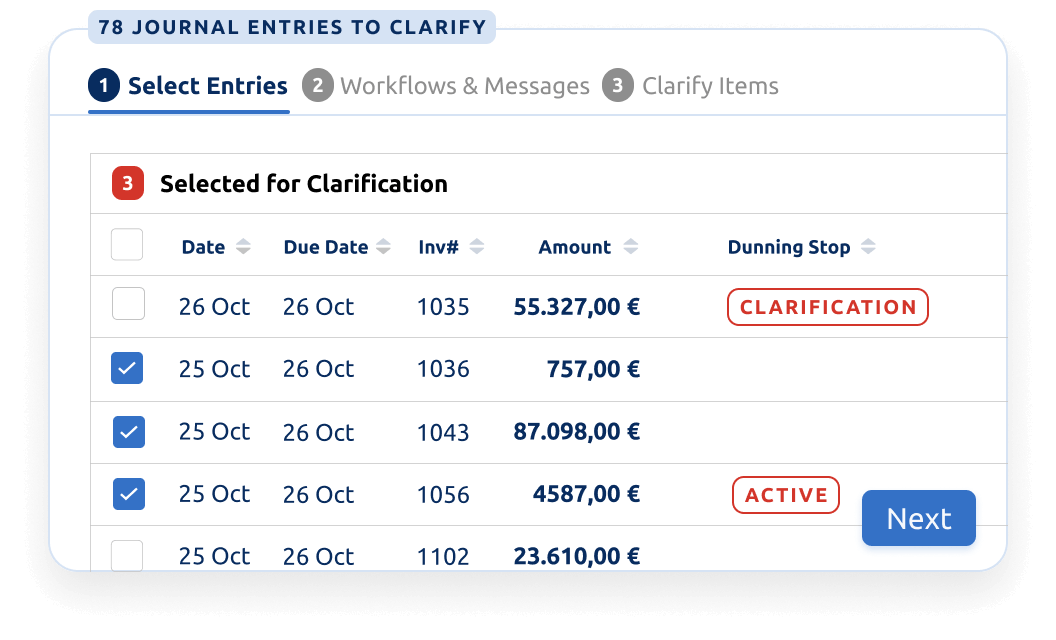

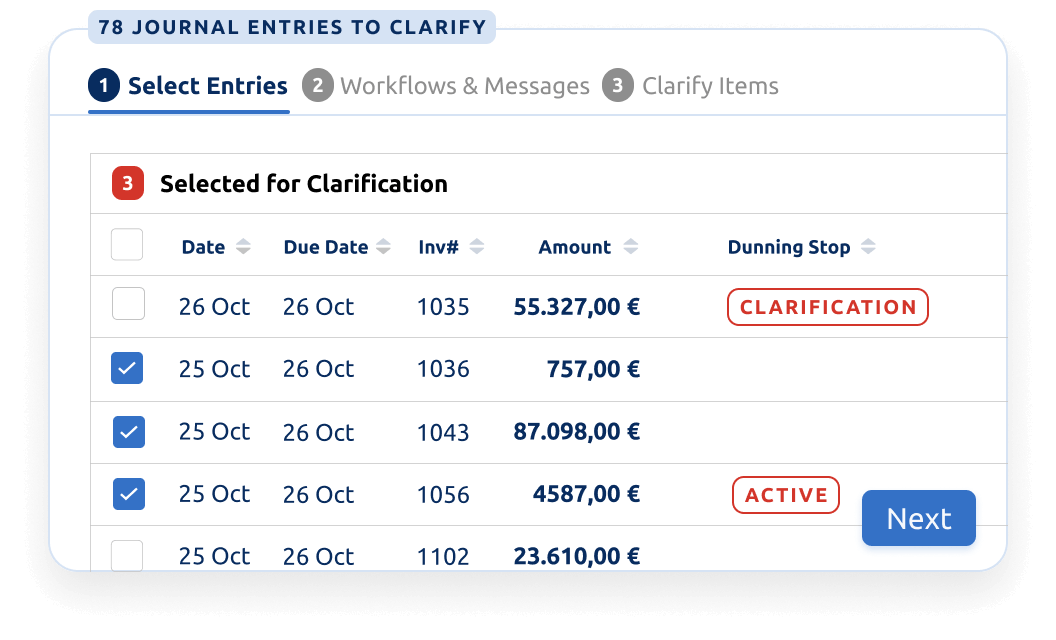

Receivables

Achieve dunning capability for all items through workflow-supported clarification of open items.

Automatically clarify open items at the right time, with the right questions and the right person - without any manual effort.

Workflows

Gain full control over open item clarifications and complaints with intelligent automation options.

Automatic escalation

If there is no response from colleagues, ensure the necessary attention through automatic internal escalation.

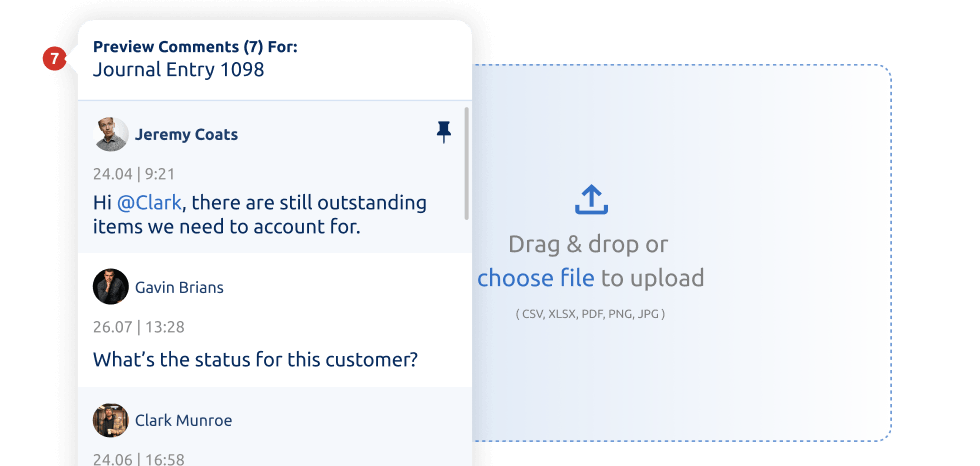

Central clarification file

Increase transparency and process reliability by documenting all activities in the central clarification file.

Structured answers

Facilitate the answering of clarifications and analyze the most common reasons for a precise evaluation.

Automatic side effects

Increase the scalability of your processes with dispute-based dunning blocks and automatic follow-up actions.

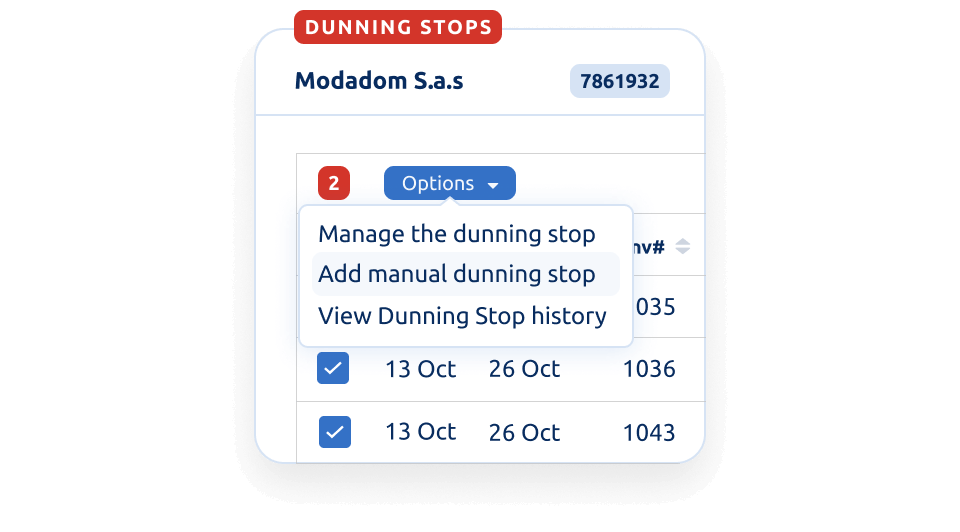

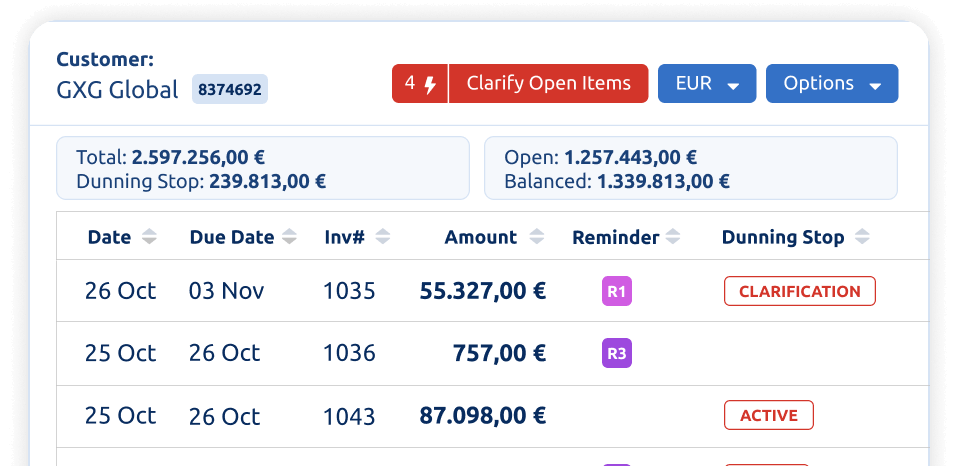

Receivables

Block debtors and items according to a consistent concept in order to avoid long collection periods and ensure a rapid return to the regular dunning process.

Clarification-based dunning blocks

Reduce considerable effort for the preparation and follow-up of the dunning run by automatically activating dunning blocks for open items in clarification.

Time-controlled dunning blocks

Set dunning blocks with expiration dates at both customer and document level with just a few clicks.

Dunning block history

Ensure audit-proof traceability of the periods in which dunning stops were active.

Dunning block guideline

Prevent the uncontrolled activation of dunning blocks to avoid unnecessarily extending your collection periods.

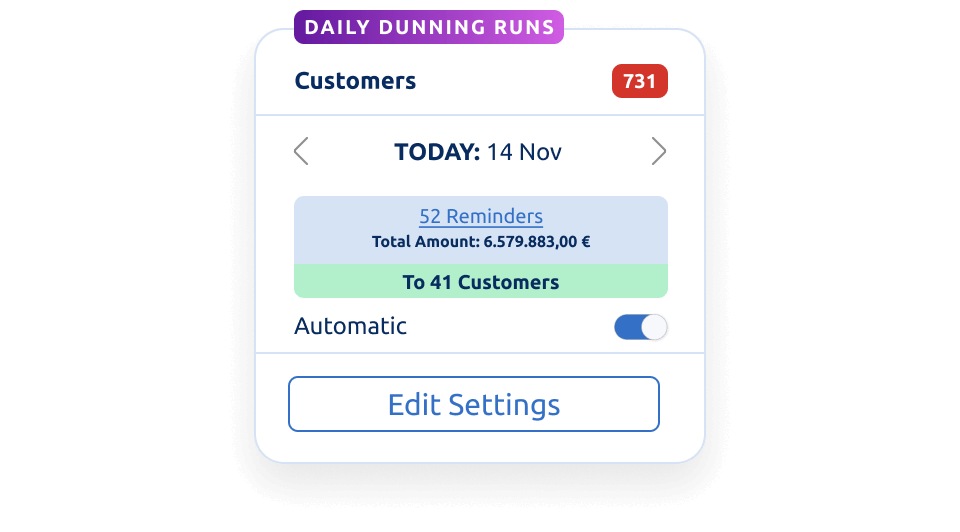

Receivables

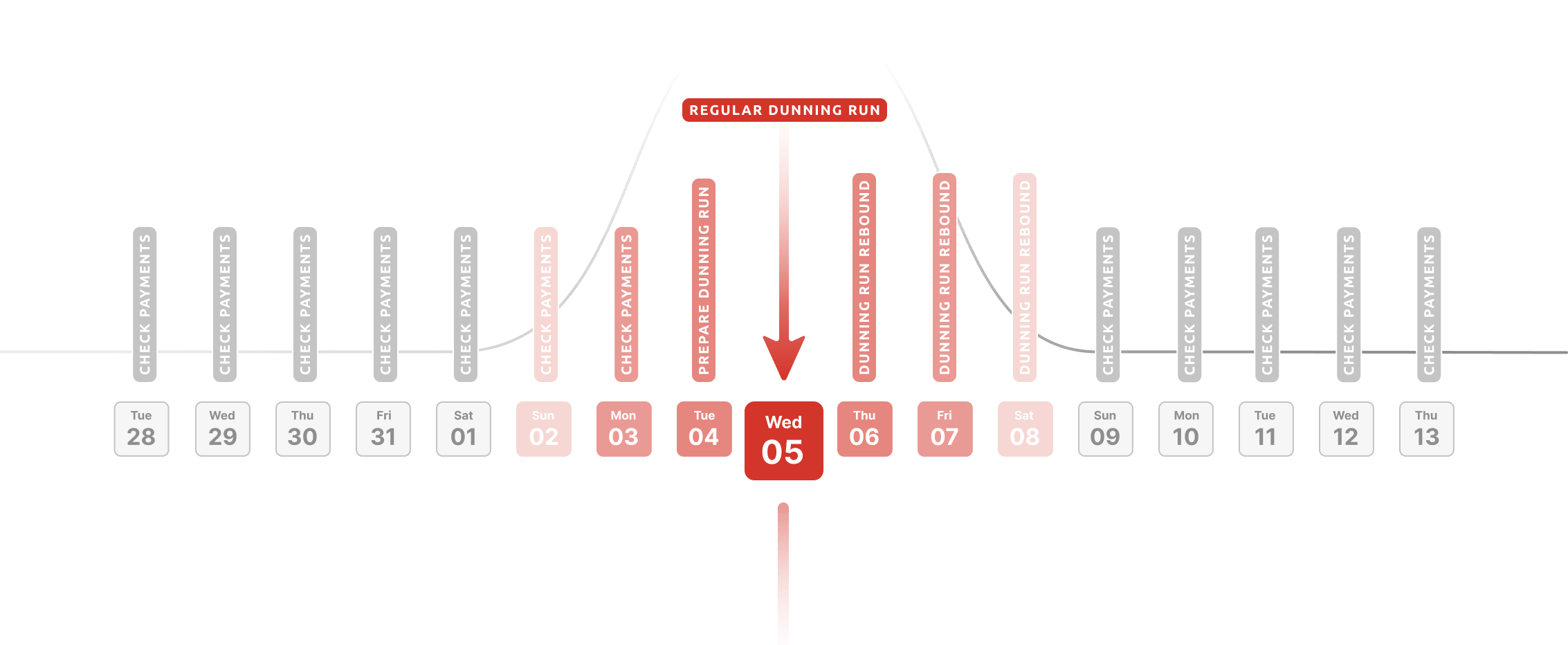

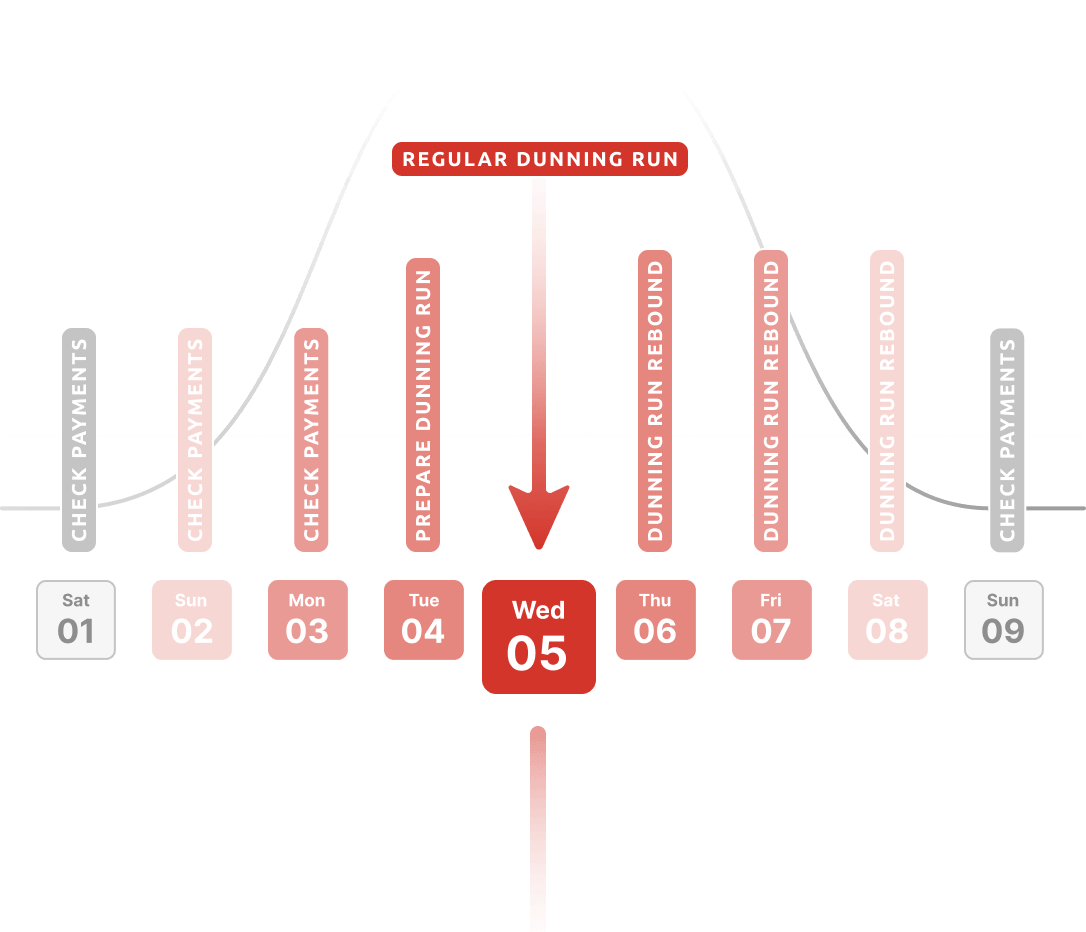

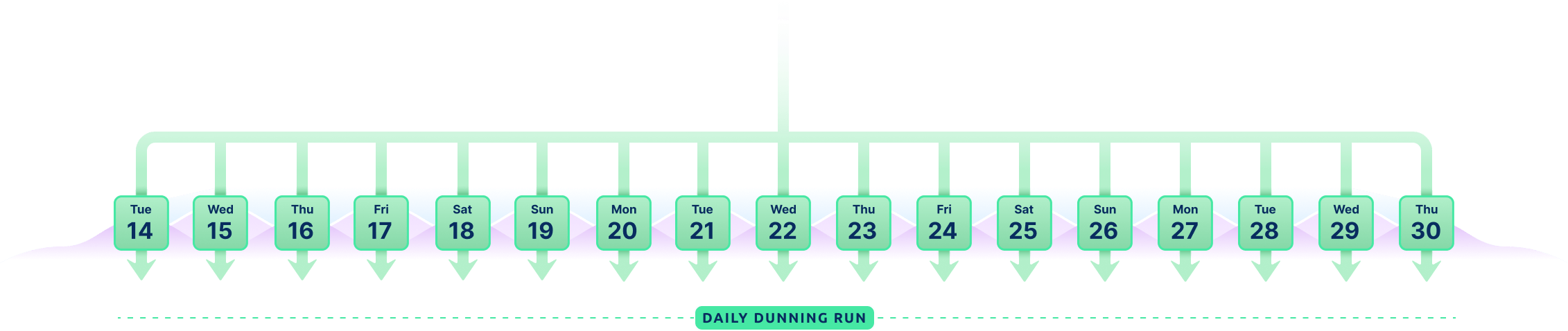

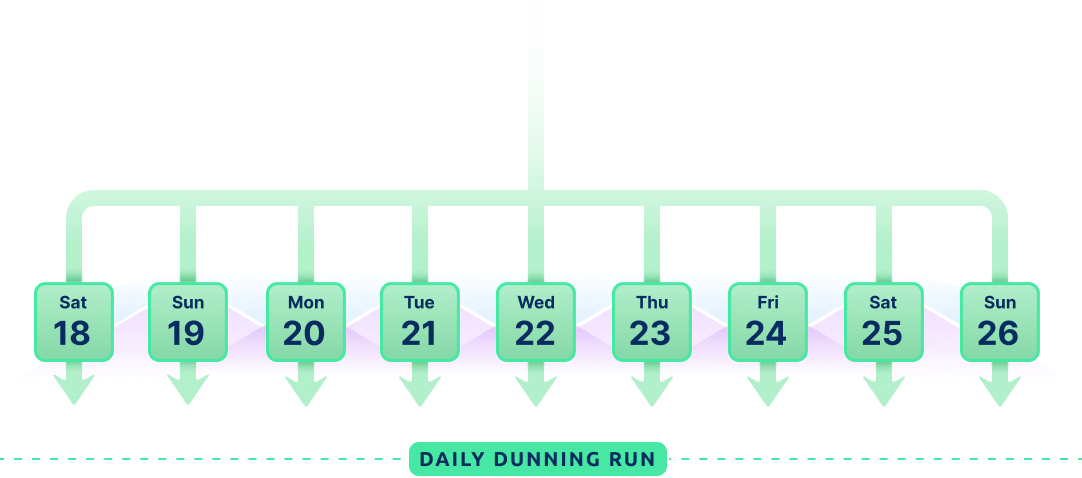

Reduce the time and effort required for the pre- and post-processing of dunning runs in your accounts receivable department and all teams involved, and avoid unnecessary customer complaints.

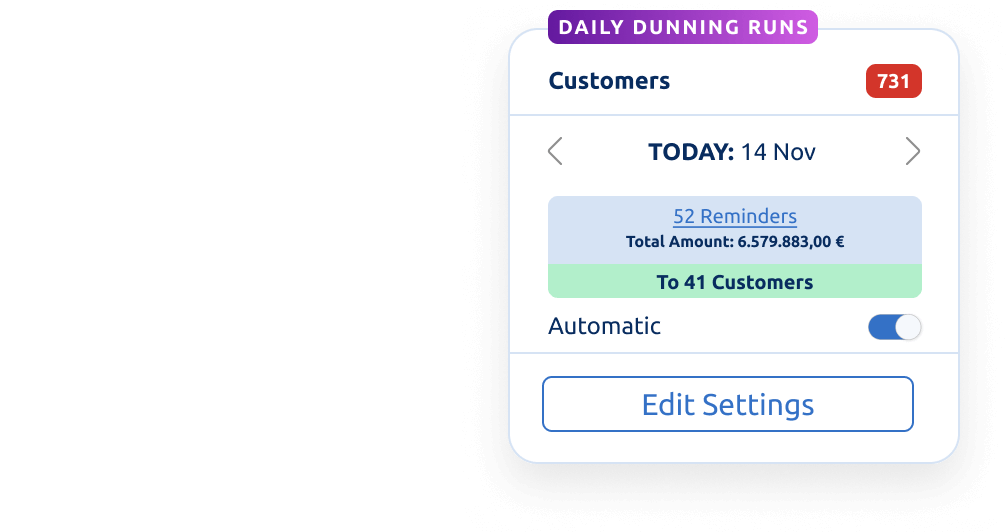

Dunning proposal list 2.0

Enable a daily, rolling dunning process based on continuous automatic recalculation of dunning contents and times.

All systems included

Add relevant documents such as original invoices and orders to your reminders to minimize customer queries.

Quick preview

Check and send multiple reminders with minimal effort thanks to our quick preview.

Automation rules for sending reminders

Significantly reduce your efforts for sending reminders with configurable automation rules that allow you to send “simple” reminders automatically.

Full-service dispatch & own lettershop

Benefit from our fully integrated interfaces to postal service providers or send reminders via your own lettershop.

Receivables

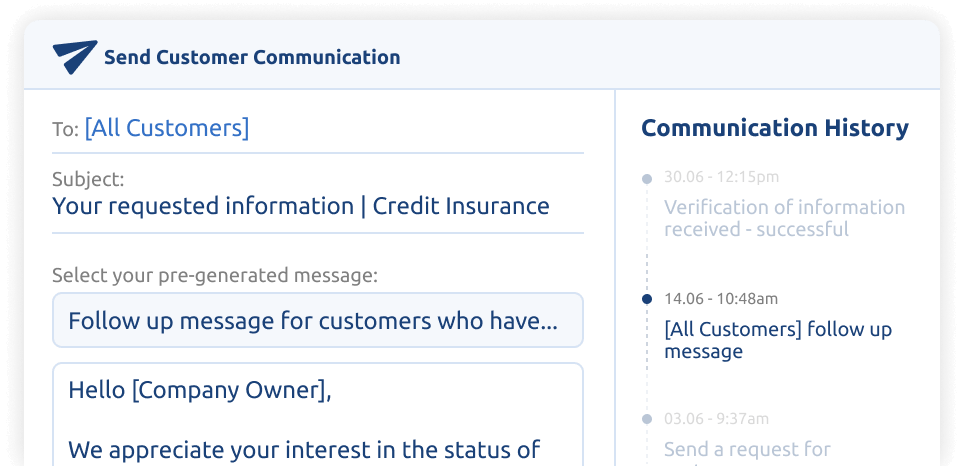

Sending customer letters

Send standardized customer letters with just a few clicks and document the dispatch.

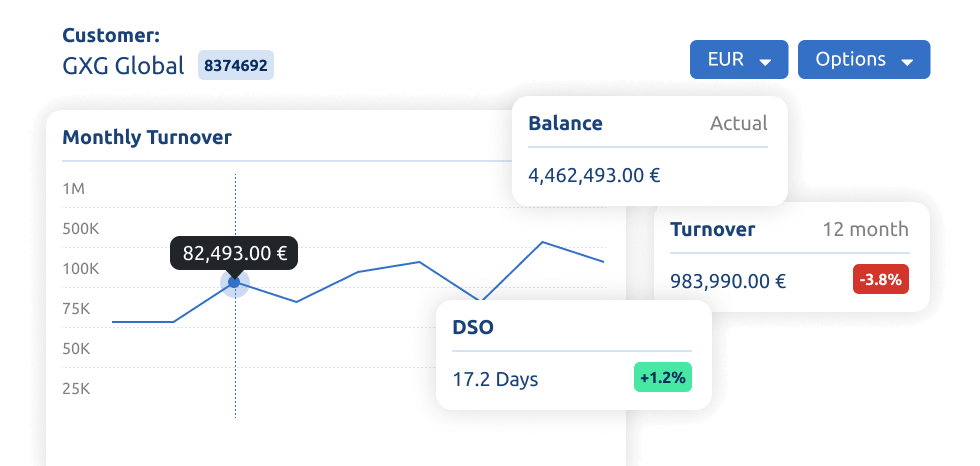

Analyze customer behavior

Identify trends such as payment behavior, sales development and age of receivables at customer level.

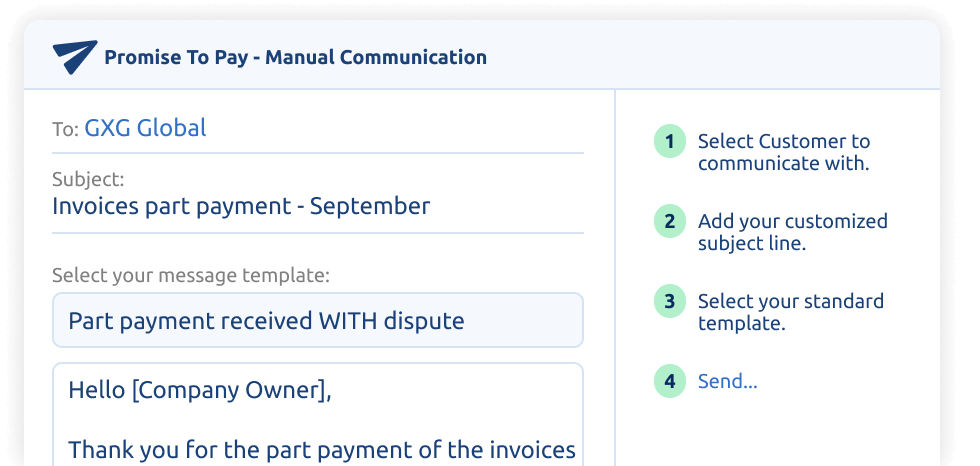

Document promises to pay

Send manual customer letters based on individual standard templates with just a few clicks.

Comments & attachments

Document all important activities chronologically with your colleagues at customer and document level.

360° Accounts receivable view

Gain full transparency of all activities relating to open items, reminders, clarifications, payment promises and much more in a central view.

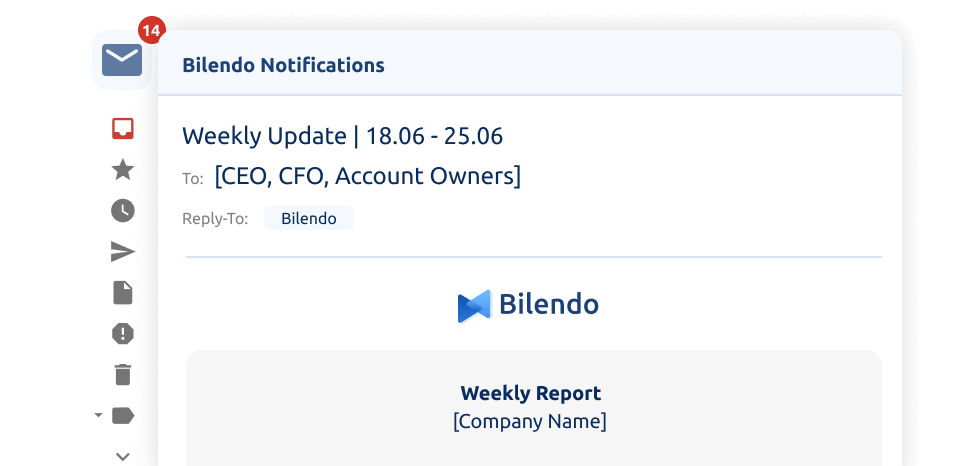

Automatic notification

Receive important information about customers, reminders and clarifications for important activities automatically.

Receivables +

Expand your accounts receivable processes with the additional products and add-ons available in Bilendo.