Effective credit management, faster incoming payments and simple reporting.

You can find out more by taking a product tour or contacting sales.

The Advantage

DSO Reduction

Automation of workflows as well as efficient collaboration on open items have a direct impact on your DSO.Turnover

Centralized, real-time information enables fast credit decisions and is proven to drive revenue with your customers.Savings

Lower payment defaults, rapid incident handling and process automation reduce finance costs.Plus

Significant increase in customer satisfaction, as the work is less repetitive, there is more time for strategic tasks, complexity is reduced and an increased spirit of innovation.

Tiemeyers Success

Plus

Higher user satisfaction thanks to simplified processes, real-time complaint resolution, fewer disputed invoices, and greater process transparency.

How Porsche does it

Our Products

Success Stories

Many well known companies have already implemented and use Bilendo. Read about some of their successes here.

All Success Stories

Benefits

Put an end to manual tasks, unintuitive software and high implementation requirements. Start a new era with Bilendo.

Full Automation

Bilendo automates manual tasks in your accounts receivable department and makes them efficient.

No Automation

Your accounts receivable department regularly performs time-consuming, laborious, and manual tasks.

Easy to use

Bilendo cloud software is simple and intuitive. Your users don't need any training.

Complicated operation

Due to the complicated software, only experienced employees can perform the tasks.

Efficient communication

All customer and open item communication takes place centrally in Bilendo.

Chaotic communication

There is no central location where communication to your accounts receivable and OPs takes place.

Maximum transparency

Finally, your open items and accounts receivable are accessible in real time for all parties involved.

Poor transparency

No one knows the real state of affairs. Reports are not up to date and are often meaningless.

"Bilendo hits the zeitgeist. Very refreshing!" - Rudolf Keßler — President BvCM

Bilendo processes more than 25 Billion Euro of receivables volume, from over 5 million debtors and by tens of thousands of happy users. Every Day.

Our Success Stories

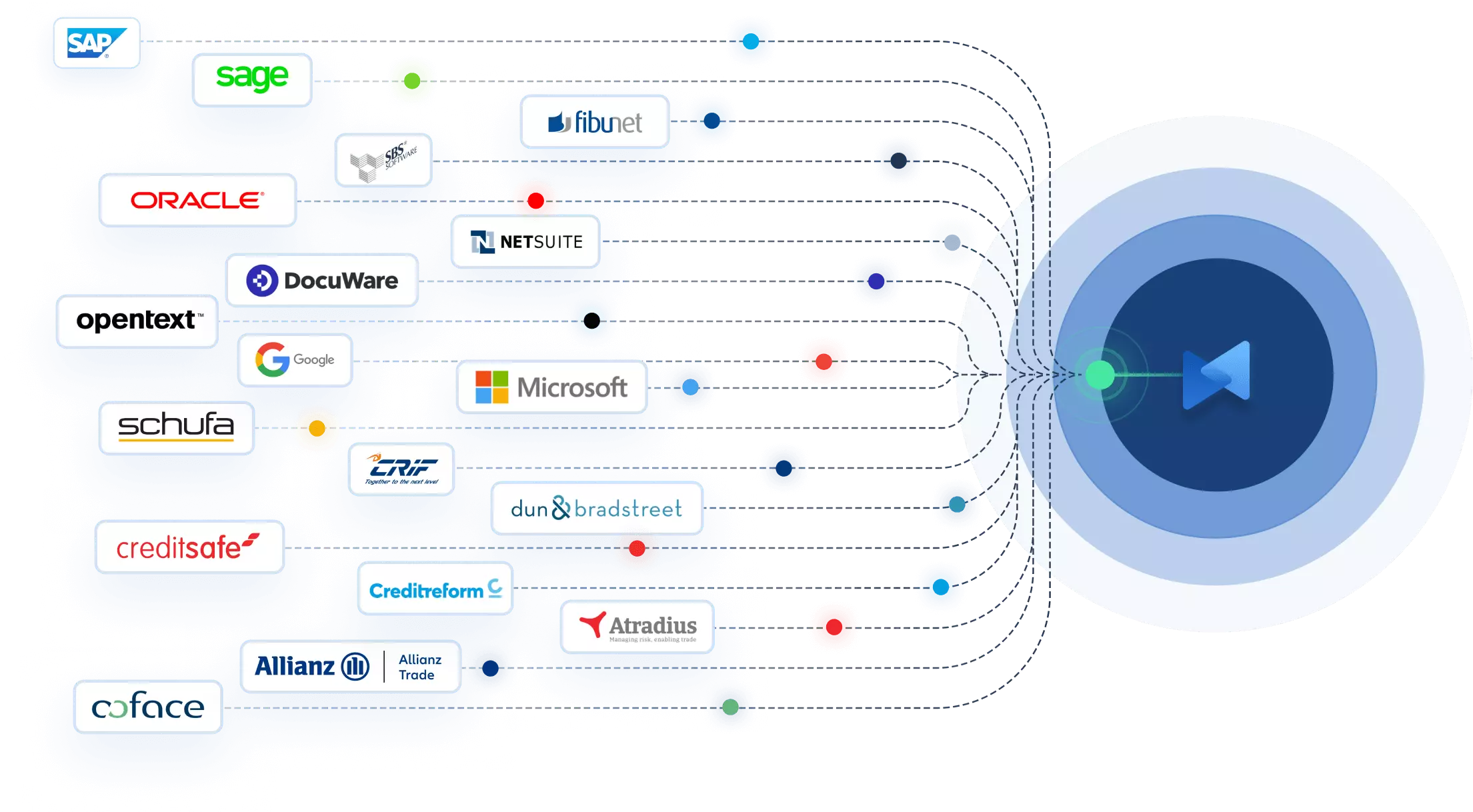

Simple connection

Thanks to the flexible Bilendo integration layer, the path to the cloud is possible for your company with very little (if any) IT effort.

Integration & Connection

FAQ

Here you will find the most frequently asked questions and the appropriate answers in a simple and clear manner.

AR Automation stands for Accounts Receivable Automation, i.e. the software-supported automation of processes in accounts receivable accounting. These include processes such as Open Item Management, Dunning, Clarification Management, Dispute Management, Reporting and the management of Debit Notes.

Credit Management is concerned with the efficient management of credit on the debit side in the form of customer loans granted. These customer credits arise from the granting of payment terms (e.g. 30 days) and open items. In order to reduce payment defaults and high levels of outstanding accounts, it is important to keep track of open items and granted credit limits (e.g. 50,000.00 EUR) and to actively manage them. Modern credit management software is able to divide customers into risk classes. This modern solution combines internal parameters in the so-called internal credit scoring (e.g. payment experience) and external parameters in the so-called external credit scoring (e.g. credit agency information, external payment experience). These tasks are usually performed with the help of software by credit management staff, the credit managers. The management function in credit management reports to the finance department, at most to the CFO. Often, a Head of Treasury has strategic responsibility.

AR Automation is concerned with the automation of debtor processes. In credit management, it is about the administration of granted customer credits and their risk profile (credit scoring). In both cases, the efficient use of software is indispensable. Workflows, i.e. plannable rules of behavior and decision paths for software, help to make a large number of decisions automatically and to facilitate the daily work of users (accounts receivable clerks, credit managers).

Data security at Bilendo is ensured through three interconnected components. Firstly, through the security of the infrastructure; secondly, through the security of the information systems; and thirdly, through the security of the application itself.

The processing of your data takes place according to the highest security standards (according to DSGVO / GDPR) on German servers. Your data and that of your customers is located in Frankfurt a. M. in a state-of-the-art data center of Amazon Web Services Germany (AWS). AWS data centers are certified according to ISO27001, ISO27018, ISO27017, PCI DSS Level 1 and SOC1-3.

Any connection to and from Bilendo is only SSL encrypted.

In addition to pure data transfer encryption, Bilendo protects all incoming and outgoing data transfer via the Cloudflare cloud firewall service.

Furthermore, Bilendo undergoes regular audits / certification within the framework of ISO27001 and TISAX.

Ususally only a few days pass from the decision to introduce the system to the initial implementation. As part of a proof-of-concept (POC), we support you in extracting the data, integrating Bilendo into your processes and introducing it to your employees. From order to go-live, you should allow 8-12 weeks per market/country. Global rollout projects are continuously supported by our Customer Onboarding Team.

Yes, but not many. Bilendo is a true cloud application that doesn't require installation, customization, or time-consuming updates or maintenance from you. Our implementation architects support you in extracting the data from your source system.

You work with Bilendo, we take care of the rest.

No. All configuration, settings and workflows are designed in such a way that they can be carried out by your specialist department without IT knowledge. Otherwise: You work with Bilendo, we take care of the technology.

Prices are not based on your sales.

Instead, we rely on "value-based pricing", which is based on how much added value we create for your company. This is based on the number of active debtors and the number of active users. If a debtor is part of a dunning run, part of an internal clarification or part of a customer letter, it is classified as an active debtor. Thus, we only charge for your "problem customers", i.e. exactly where you also have the most effort.

Hint: At the beginning of using Bilendo, it can be difficult to determine the exact number of active debtors. A good guideline of monthly active debtors is the number of reminders sent per month. Our billing and payment methods help companies find this. Monthly billing automatically adjusts to demand. The annual billing brings predictability and calculates the monthly overuse.

You can import your data from different sources/systems at Bilendo. First and foremost, your customer sub-ledger is important.

Different systems, such as your ERP or CRM system, can be easily connected to Bilendo via interfaces (API) or via batch interface. The number of systems does not matter.

If you have several financial systems in use or want to consolidate many company codes in one place, you can use Bilendo to create a central data point and establish a homogeneous process across the various data pools. This way you increase efficiency and transparency in your company.

At the beginning of the cooperation, we provide you with a free test account. In the test account, you can first get to know all functions with exemplary data.

Later, we will integrate your data from the customer sub-ledger into this test account in order to put the processes through their paces. The fully encapsulated test environment ensures that you can test comprehensively without your customers noticing.

At the end of the test phase, we hand over a "turnkey" system that you can transfer to the productive processes in your company after approval.

No problem, our solution experts will be happy to help you. Just make an appointment for a non-binding Demo. Or try out Bilendo for yourself with a Product Tour.

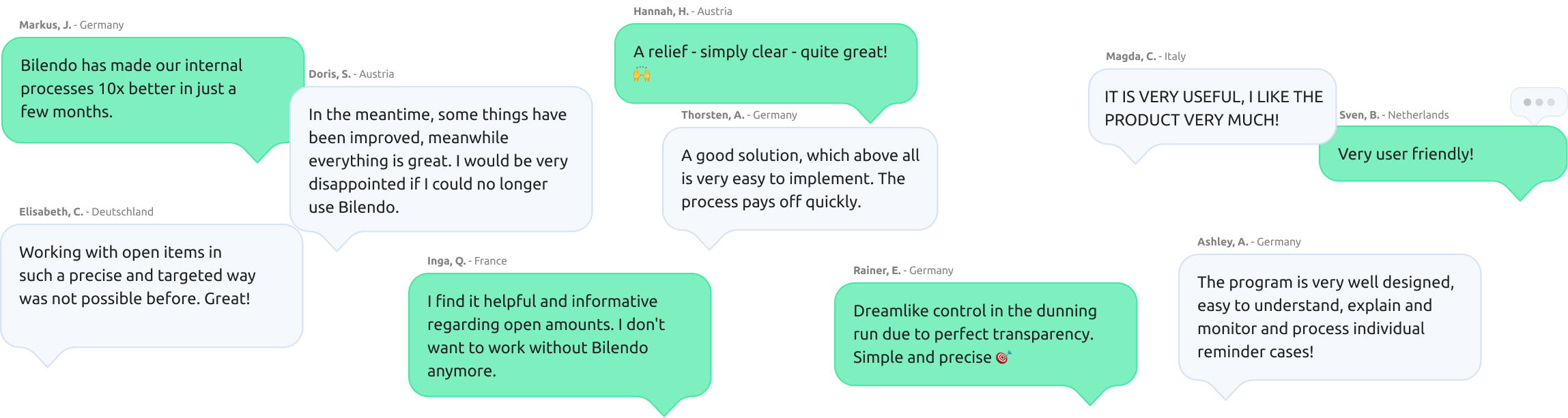

Our users